This specialist policy covers any physical damage to both the original structure and the contract works. The policy also offers alternative accommodation cover if, as a result of a loss, there is a prolonged delay in moving into the property.

This cover would also protect the property owner from any legal liabilities arising during the course of the works.

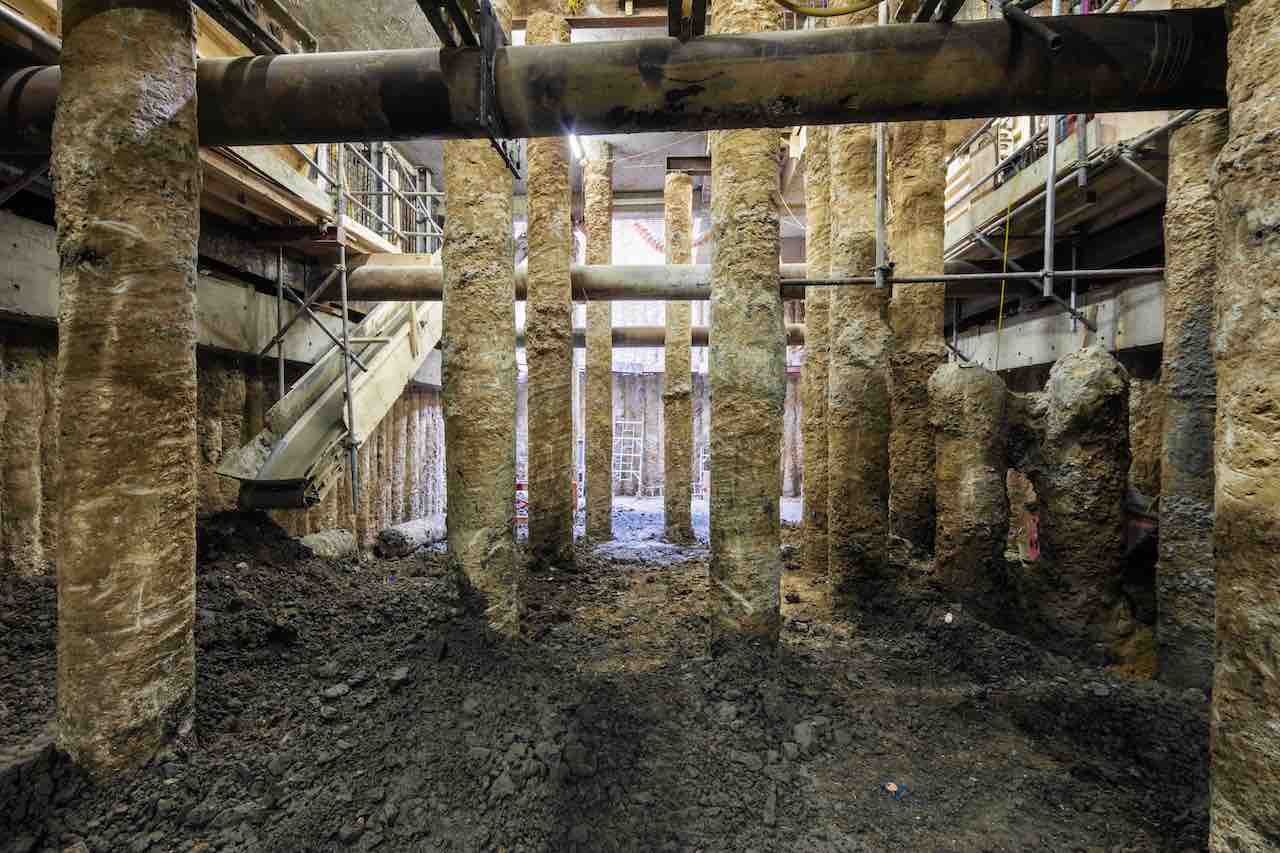

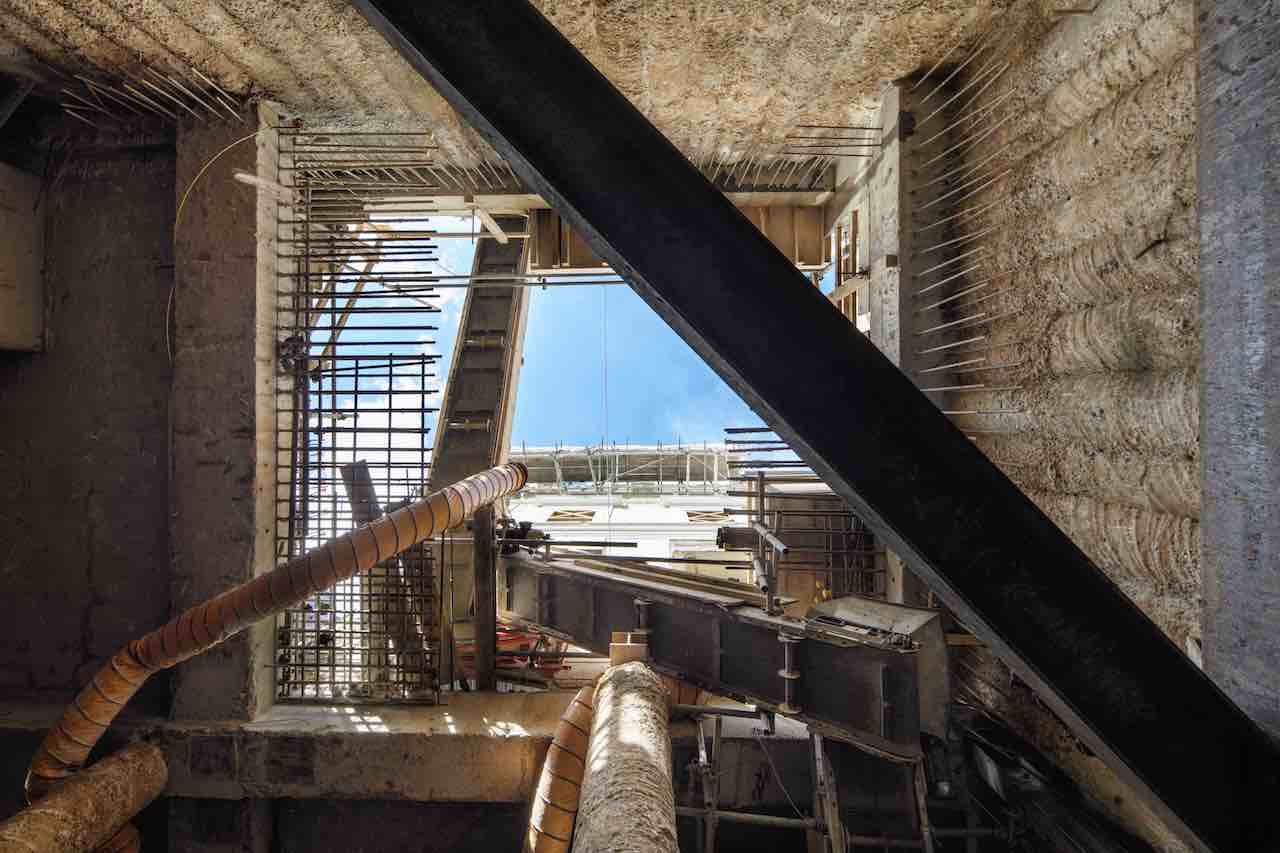

We have arranged insurance for over 500 different projects with contract values up to £30m. These include substantial basement excavations and extensions to prime London residential property, country houses and listed properties.

Having worked through numerous complex claims, we have gained a unique insight into this specialist area which we readily share with our clients and their professional teams.

When undertaking works near the party wall, there is always a risk that damage can be caused to the adjoining or nearby property. If there is underpinning or piling close to another structure then there is undoubtedly an increased risk.

Non-Negligence Insurance, also known as Party Wall Insurance or JCT 6.5.1, provides property owners with protection against damage to any property which is not caused by contractor negligence.

This cover will typically be required by an employer under JCT clause 6.5.1

The risks covered by this policy are very specific and are actually named in the JCT Contract as:-

A structural warranty, also know as latent defects insurance, provides protection against the cost of repairing, restoring or strengthening a property if damage occurs as a consequence of an inherent defect in the structural or non-structural elements of a building and/or in the mechanical or electrical services of the building.

The main benefits associated with a structural warranty are’

Performance Bonds, also known as Contract Bonds are a type of Surety Bond and are written promises to pay for direct loss or damage suffered by a third party as a result of a breach of contract and are typically issued for 10% of the contract value.

The Performance Bond is essentialy Guaranteeing the contractors obligations to complete the works and is often put in place prior to the works commencing.

Performance Bonds are common in construction projects and protect the Employer against the Contractor failing.