Household insurers have no appetite for insuring major building works. These projects fundamentally change the risk profile of your home; from a dwelling to a building site, for which their cover is not designed. As such, your insurer will inevitably cancel your policy from the point the work starts, or strip cover to its most basic perils for the duration of your project. No cover will therefore be in place for the existing structure, the works, or your liability as property owner to third parties. In effect, you and your home will be left completely uninsured.

It is likely you will be signing a JCT (Joint Contractors Tribunal) contract in joint names with your contractor which specifies that you, the property owner, are obligated to arrange cover for the works.

Some homeowners may think that the contractors’ own cover will be sufficient and specialist insurance is not required. This is not a good idea for a variety of reasons-

The contractor has no insurable interest in your home, only the works contract. Therefore, the existing structure (your home) will not be covered under their policy during the work.

Their own insurance may be a basic policy with lots of warranties and exclusions, leaving you exposed.

If the contractor’s cover fails or is absent (for example, insolvency), the result could be a large uninsured loss for you, the homeowner.

If the contractor breaches their policy conditions and their insurer voids their policy, there is no ‘non-vitiation’ clause in place preserving your right to claim under their policy.

Under a JCT Contract, it is your responsibility to arrange insurance for the works.

This article gives an indication of the potential consequences of relying on a contractors’ insurance-

https://www.theguardian.com/money/2021/mar/13/family-bill-insurer-claim-house-loft-renovation

Cover is arranged in joint names between you and your contractor as per the terms and conditions of your JCT contract, insuring against material damage to the works and existing structure.

Alternative Accommodation in the event of a claim.

Property Owner’s liability, commensurate with the size and complexity of your project, covering your liability to neighbors, the public and the workmen on site.

A non-vitiation clause, preserving your right to claim under the policy even if your contractor breaches the policy conditions.

As the Property Owner undertaking contract works, you owe a duty of care to your neighbors. Consequently, if damage occurs to their property, you will be held legally liable.

This is reinforced by the Party Wall Act 1996 which requires you to compensate your neighbors in full for damage and any consequential loss, even in the absence of a negligent act (strict liability).

Although your contractor’s public liability will be first in line to indemnify third party damage; liability would only attach to them in the event of a negligent act.

Your neighbor and their party wall surveyors may insist you take out a non-negligent liability insurance policy to cover the cost of claims made for loss or damage to their property which occurs in the absence of negligence. This is almost a certainty in the case of basement work.

C+P are market specialists in this complex area of insurance.

Together with our panel of underwriters, we have helped shape a JCT contract compliant policy which meets your duties and responsibilities as a homeowner whilst your property is undergoing renovation.

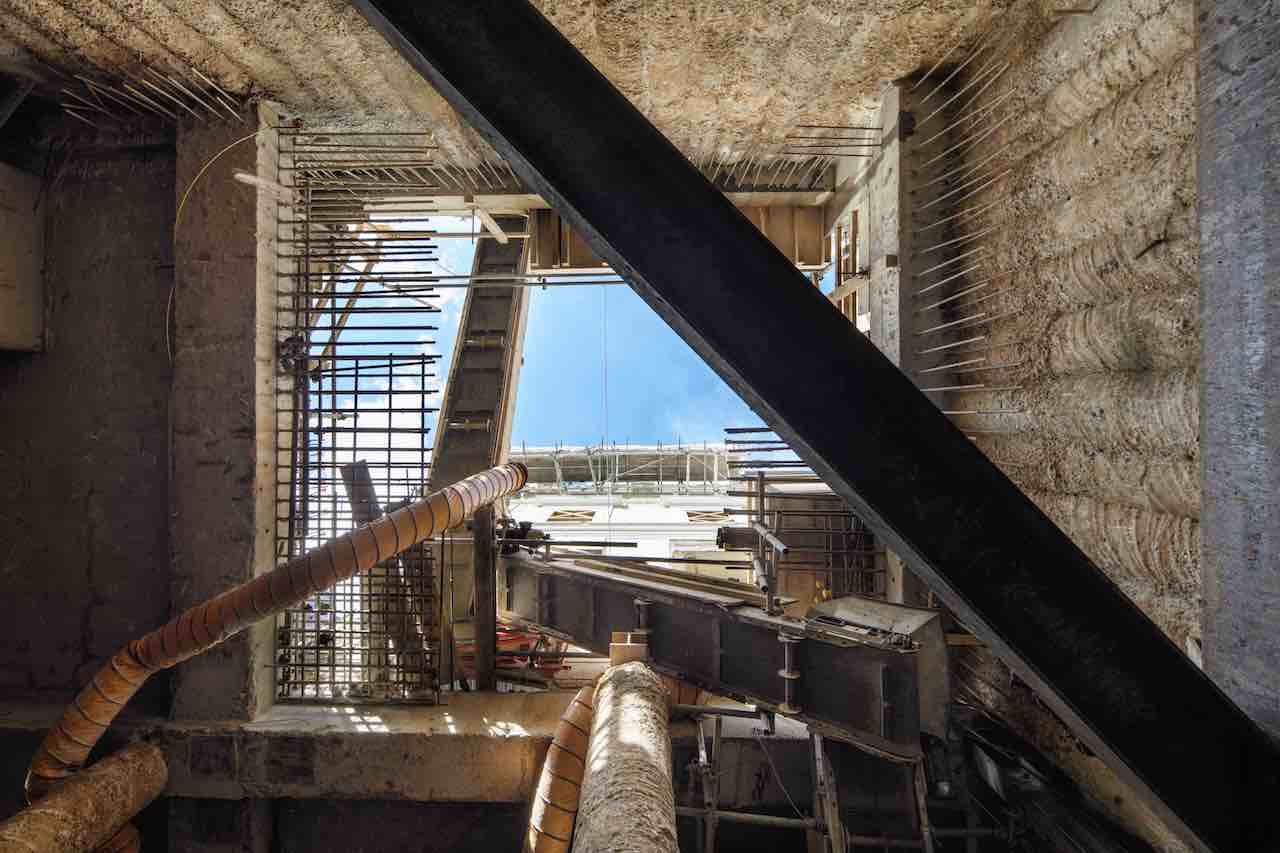

We have insured over 500 major home renovation projects with contract values ranging from £250,000 to £30m. These projects have included substantial basement excavations to prime London residential property, and major extensions and refurbishments of country houses and listed buildings.

The photographs displayed on this page are a small sample of some of those projects.

We are frequently asked to source additional layers of protection for our clients undergoing major renovation projects. This is not just limited to non-negligent liability cover. Many of our clients request assistance in acquiring performance bonds and structural warranties, which we are well placed to assist with.

C+P have grown to excel in this niche area of insurance. Please do not hesitate to contact us directly or complete the enquiry form below if you require our assistance.